ohio sales tax exemption form example

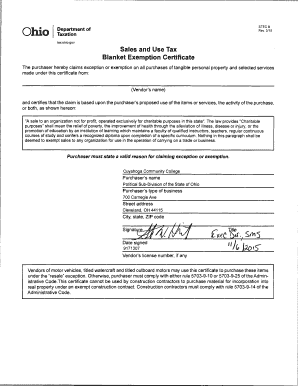

573902B1 SR Salvage Resale A salvage dealer taking a salvage title to a vehicle that is to be dismantled and sold as parts may claim an exemption from sales tax. Purchaser must state a valid reason for claiming exception or exemption.

How To Get A Sales Tax Exemption Certificate In Ohio Startingyourbusiness Com

PdfFiller allows users to edit sign fill and share all type of documents online.

. Consumer means the person. This page discusses various sales tax exemptions in Ohio. Since the majority of exceptions or.

Ad Vast Library of Fillable Legal Documents. Ohio sales tax exemption form example. Fill out the Ohio sales tax exemption certificate form.

Farming is one of the exceptions. A typed drawn or uploaded signature. In addition to requiring purchaser information such as name address and business type Ohio.

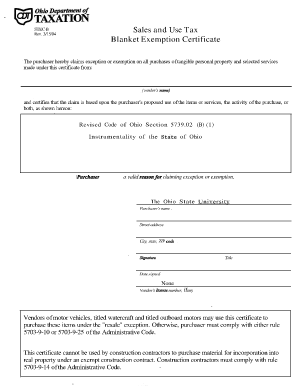

The advanced tools of the editor will guide you through the editable PDF template. SP StatePolitical Subdivision - The State of Ohio or any political subdivision thereof is exempt from sales tax on motor vehicles. In transactions where sales tax was due but not collected by the vendor or seller a use tax of equal amount is due from the customer.

Accepted in trade can reduce the tax base of a motor vehicle. The state sales and use tax rate has been 55 percent since July 1 2005. Microsoft Word - Sales Tax Exemption Formdoc Author.

Once you have that you are eligible to issue a resale certificate. Counties and regional transit authorities may levy. Farmers have been exempt from Ohio sales tax on purchases used for agricultural production for several decades.

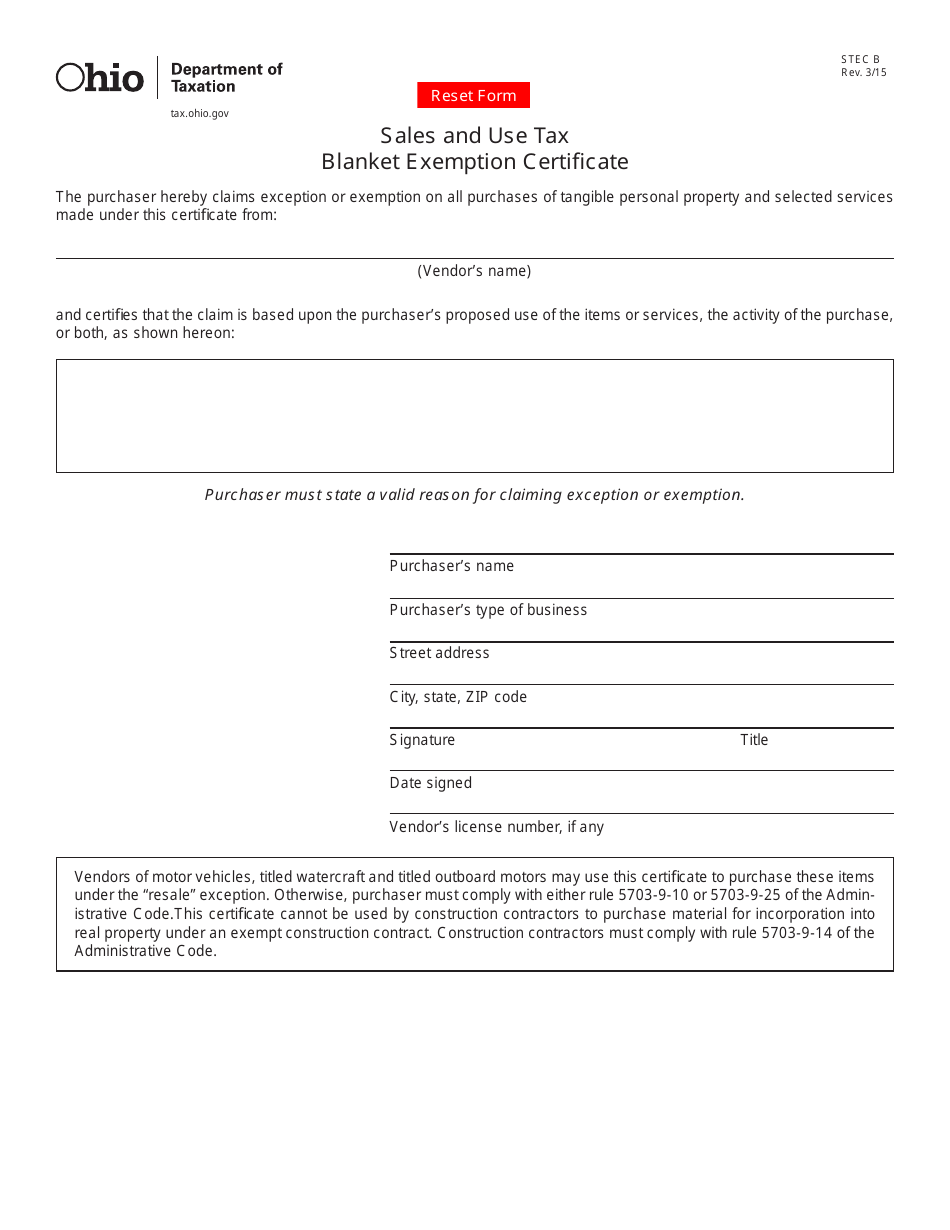

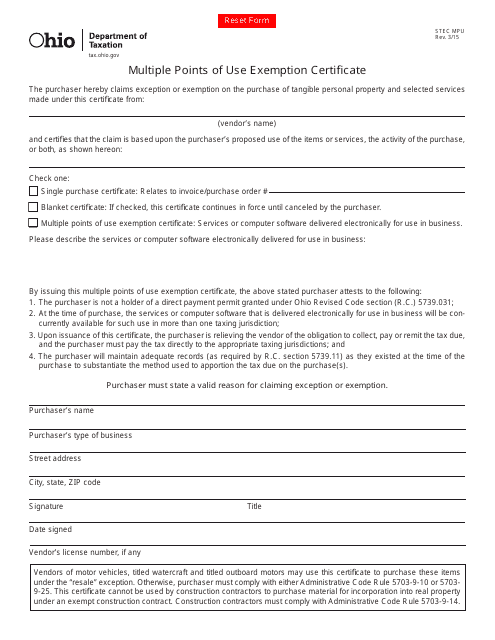

However this does not make all purchases by farmers exempt. The purchaser hereby claims exception or exemption on all purchases of tangible personal. The Ohio sales and use tax applies to the retail sale lease and rental of tangible personal property as well as the sale of selected services in Ohio.

Printing and scanning is no longer the best way to manage documents. ST_STEC B_GEN_FI Created Date. Currently Ohio sales tax is charged on all sales of tangible personal property and services unless there is an exception to this tax.

573902 B 32 Nonprofit. Use the unit or blanket exemption certificate contained in this rule. For example a new car is priced at 18500 and the customer receives a trade-in allowance of 500 leaving the net difference 18000.

Handy tips for filling out Ohio Tax Exempt Form Pdf online. Handy tips for filling out 2021 printable ohio tax form online. A Salvage Dealer Permit and Vendor License are required.

Ohio sales tax exemption form example. Only one set of back-up documents is needed. Free ohio tax exempt form fill line printable fillable model from ohio tax exempt form templates with resolution.

PdfFiller Allows Users to Edit Sign Fill and Share All Type of Documents Online. For other ohio sales tax exemption certificates go here. Ohio Sales Tax Exemption Form.

Sales Tax Exempt Exemption Simple Online Application. The way to fill out the Tax exempt form Ohio online. 3302012 35314 PM.

A few examples of exemptions for motor vehicles. To get started on the blank utilize the Fill camp. Therefore you can complete the Ohio sales tax exemption certificate form by providing your Sales Tax Number.

In Ohio certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers. Go digital and save time with signNow the best solution for electronic signaturesUse its powerful functionality with a simple-to-use intuitive interface to fill out Ohio sales tax exemption form 2021 online e-sign them and quickly share them without. Box 530 Columbus OH 43216-0530 888-405-4039.

Enter the name of the vendor from whom you are making the purchase. Real property under an exempt construction contract. 08 Real estate 09 Rental and leasing 10 Retail trade 11 Transportation and warehousing 12 Utilities.

While the Ohio sales tax of 575 applies to most transactions there are certain items that may be exempt from taxation. Sign Online button or tick the preview image of the form. To get started on the blank utilize the Fill camp.

Printing and scanning is no longer the best way to manage documents. Sales and Use Tax Refund Unit PO. Ad Download or Email OH H-3GOV More Fillable Forms Register and Subscribe Now.

On the other hand contractors may purchase materials exempt from Ohio sales and use tax based upon an exempt real property improvement. For an example of what a vaccination exemption form looks like see wyomings medical and religious vaccination exemption forms. All retail sales are subject to the tax unless they are specifically excepted or exempted in Ohios sales tax law.

Ohio Department of Taxation Attn. Send the completed form to the seller and keep a copy for your records. Though most food and drink are exempt from sales and use tax alcoholic beverages soft drinks tobacco and dietary supplements are all subject to taxation.

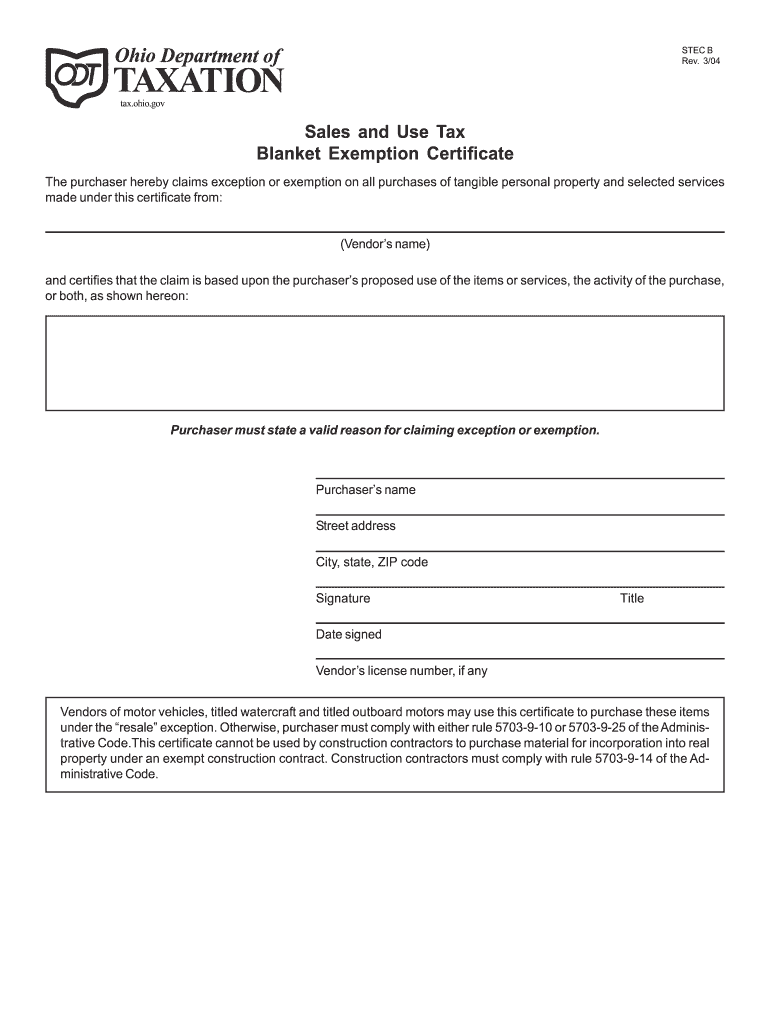

Sales and Use Tax Blanket Exemption Certificate. Obtain an Ohio Vendors License. SSTGB Form F0003 Exemption Certificate Revised 12212021 Streamlined Sales Tax Certificate of Exemption Do not send this form to the Streamlined Sales Tax Governing Board.

Go digital and save time with signNow the best solution for electronic signaturesUse its powerful functionality with a simple-to. Sales Tax Exemptions in Ohio. Construction contractors must comply with rule 5703-9-14 of the Administrative Code.

The state of Ohio provides certain forms to be used when you wish to purchase tax-exempt items such as prescription medicines. Ad signnow allows you to edit fill and sign any documents on any device. Sales tax exemption in the state applies to certain types of.

STATE OF OHIO DEPARTMENT OF TAXATION SALES AND USE TAX BLANKET EXEMPTION CERTIFICATE The purchaser hereby claims exception or exemption on all purchases of tangible personal property and selected services made under this certificate from vendor s name and certifies that the. THE ORIGINAL AND ONE COPY OF OHIO FORM ST AR MUST BE FILED. 573902 B 17 Transportation for Hire Motor vehicles used primarily in transporting tangible personal property for others may be exempt under RC.

Sams Club Created Date. Please make a copy of the application for your records. Go digital and save time with signNow the best solution for electronic signaturesUse its powerful functionality with a simple-to-use intuitive interface to fill out Ohio Tax Exempt Form Pdf online e-sign them and quickly share them without jumping tabs.

To claim the Ohio sales tax exemption for manufacturing qualifying manufacturers need to complete Ohio sales tax exemption Form STEC B which is a Sales and Use Tax Blanket Exemption Certificate and provide a copy of this certificate to their vendors. The state sales and use tax rate is 575 percent. Best Tool to Create Edit Share PDFs.

6302008 12323 PM. Ohio sales tax exemption form example. Direct Farming Farming Motor vehicles used primarily in the production of agricultural products for sale may be exempt under RC.

These include construction contracts whereby building materials are incorporated into real property under a contract with a government agency or into a horticulture or livestock. Sales and Use Tax Blanket Exemption Certificate.

Tax Exempt Form Ohio Fill Out And Sign Printable Pdf Template Signnow

Ohio Sales Tax Exemption Signed South Slavic Club Of Dayton

Form Stec U Download Fillable Pdf Or Fill Online Sales And Use Tax Unit Exemption Certificate Ohio Templateroller

Printable Ohio Sales Tax Exemption Certificates

Fill In Blank Tax Exemption Form Ohio Fill And Sign Printable Template Online Us Legal Forms

Oh Stec Co 2014 2022 Fill Out Tax Template Online Us Legal Forms

Ohio Farming Blanket Exapmtion Certificate Fill Online Printable Fillable Blank Pdffiller

Oh H 3gov 2009 2022 Fill Out Tax Template Online Us Legal Forms

Form Stec U Download Fillable Pdf Or Fill Online Sales And Use Tax Unit Exemption Certificate Ohio Templateroller

Ohio Tax Exempt Form Fill Online Printable Fillable Blank Pdffiller

Tax Exempt Form Ohio Fill And Sign Printable Template Online Us Legal Forms

Form St Ar Fillable Application For Sales Use Tax Refund

Ohio Tax Exempt Form Example Fill Online Printable Fillable Blank Pdffiller

Ohio Sales Tax Exemption Fill Out Printable Pdf Forms Online

Filling Out Ohio Tax Exempt Form Fill Out And Sign Printable Pdf Template Signnow

Form Stec B Download Fillable Pdf Or Fill Online Sales And Use Tax Blanket Exemption Certificate Ohio Templateroller

Form Stec Mpu Download Fillable Pdf Or Fill Online Multiple Points Of Use Exemption Certificate Ohio Templateroller